CASH MANAGEMENT

Cash management solution

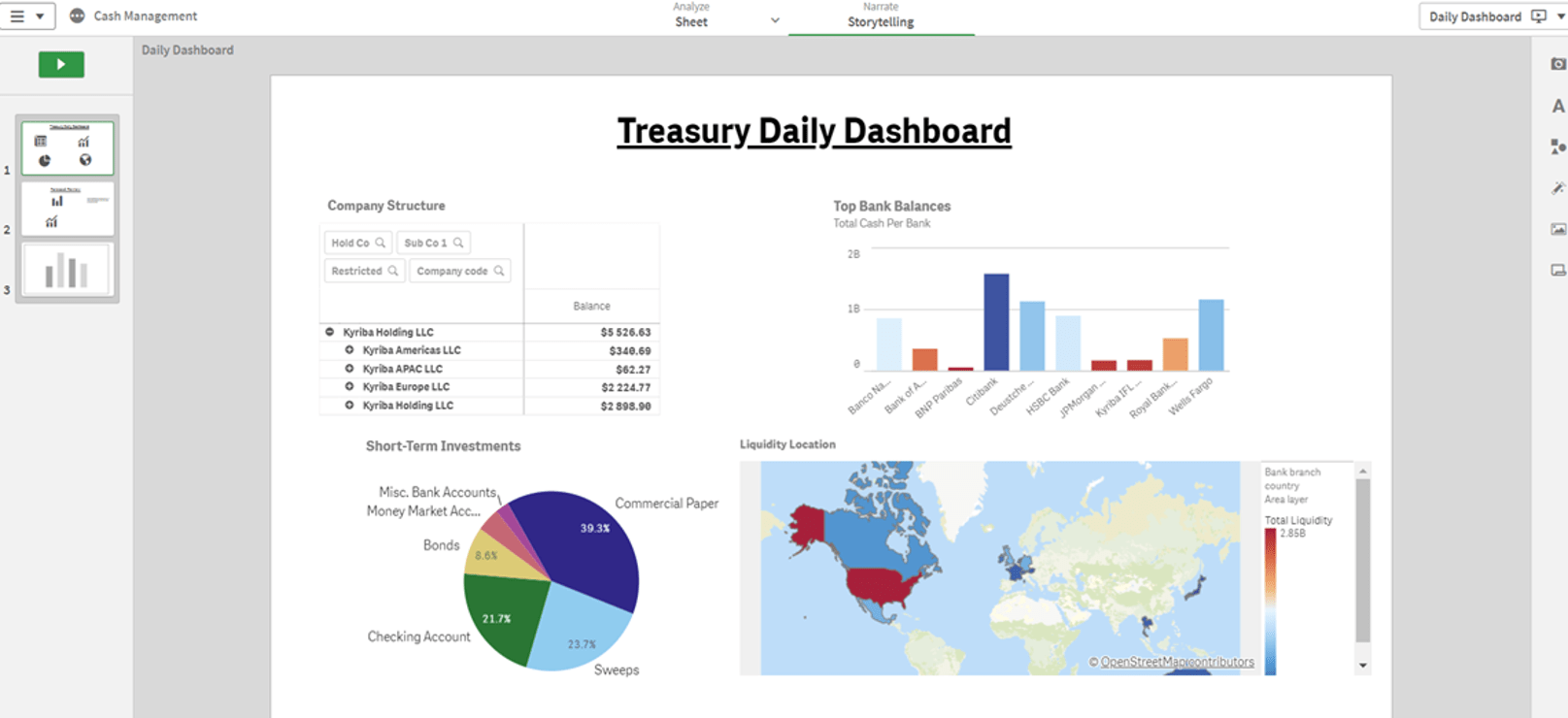

Having a cash position early in the morning, by country, company, bank, account, is possible only if cash management is automated.

- Real-time cash visibility

- Library of configurable cash reports

- Integrated banking connectivity hub

- Automatic actual/forecast reconciliation

- Intuitive and user-friendly cash management workflows

By implementing a cash management solution treasury teams can, with a single tool, automate the receipt of bank statements, integrate their cash forecasts from any ERP and reconcile bank statements to spend more time analysing and supporting strategic decision making with up-to-date cash and liquidity data in real-time.

Create reliable forecasts that generate confidence for decision making.

Back up financial decisions safely with proven data

From a single platform, minimise the amount of time required to know the company’s cash position (overall or by cost centre) and improve cash visibility to support the company’s financial, commercial and strategic objectives.

Integrated with any ERP, it unifies forecast data and simulates different scenarios with AI and BI.

Improved control over global bank accounts, analysis of bank fees, signature and proxy policy, FBAR reporting.

Quickly and intuitively manage all treasury department processes, transaction tracking and financial reporting (investments, financing, intercompany transactions, interest rate and currency management)

Automatic actual/forecast reconciliation through advanced and flexible rules (1-N, N-1, 1-1, N-N).

Two-way multi-bank, national and international, multi-protocol (Editran, Ebics, Swiftnet, SFTP) multi-bank connectivity.

All CMS offers a global view of cash management, liquidity forecasting, banking and financial transactions, allowing you to detect improvements in cash performance and optimise cash controls.

Global cash management solution

Automate, centralise and monitor liquidity in a single tool

Cash management and forecasting is critical for the finance team to make the right decisions. Having an intuitive tool gives the treasurer visibility, agility, compliance and traceability in a quick and easy way:

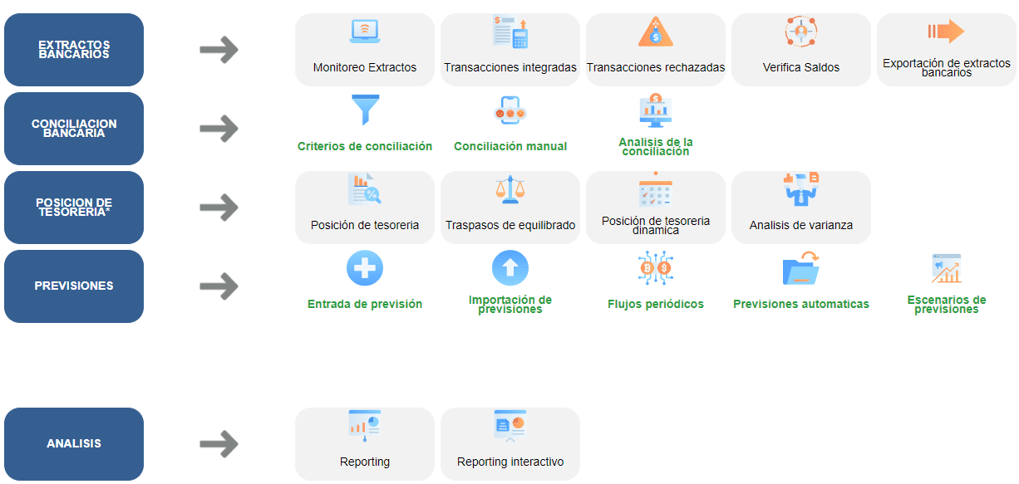

- Configurable cash management workflow.

- Monitoring of bank statements: banking connectivity cockpit, interpretation of bank statements, automatic checks.

- Reports on balances and status of bank connections.

- Integrated and rejected transactions.

- Configurable actual/forecast reconciliation with the possibility of manual reconciliation.

- Position worksheet, on value date and transaction date with filters and display parameters by budget code, country and currency.

- Library of customisable reports.

- Generation of cash forecasts: historical and projection periods, set-up variance analysis, cash position with graphical simulation, budget allocation.

All treasury processes can be automated

Liquidity is the lifeblood of any business, yet fragmented data and processes force CFOs and their teams to go the extra mile to see, protect, move and grow liquidity in order to improve financial performance.

A reliable treasury system helps finance managers promote new practices, unify real-time data and digitally transform their businesses to improve liquidity and unlock opportunities to drive growth.

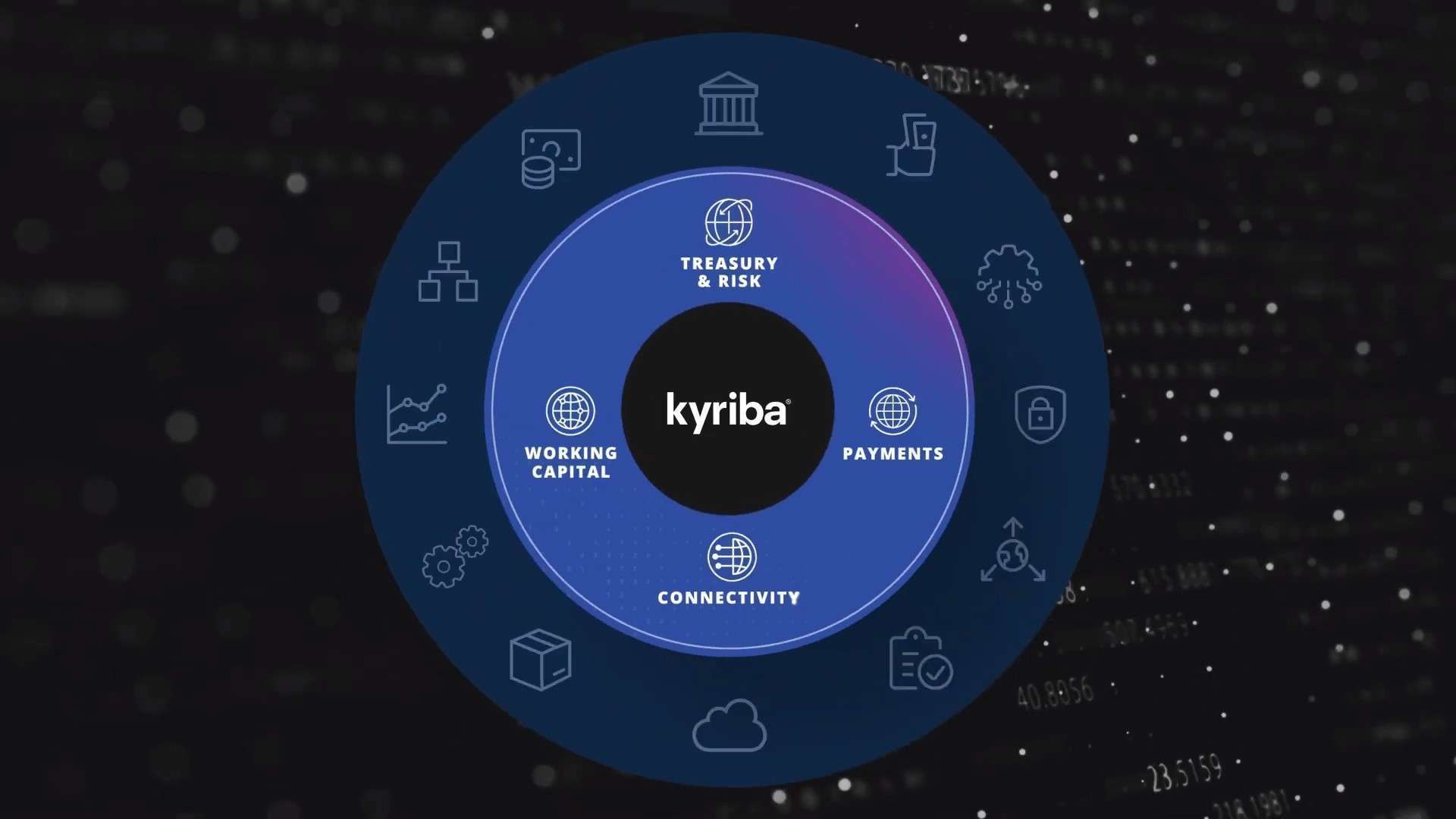

Our solution, available via API, facilitates complete cash management, as well as risk, payment and working capital management. CFOs and treasurers gain productivity, analytical capabilities and access to reliable data to protect balance sheets, improve cash returns, accelerate processes and optimise liquidity.

Effective end-to-end liquidity management

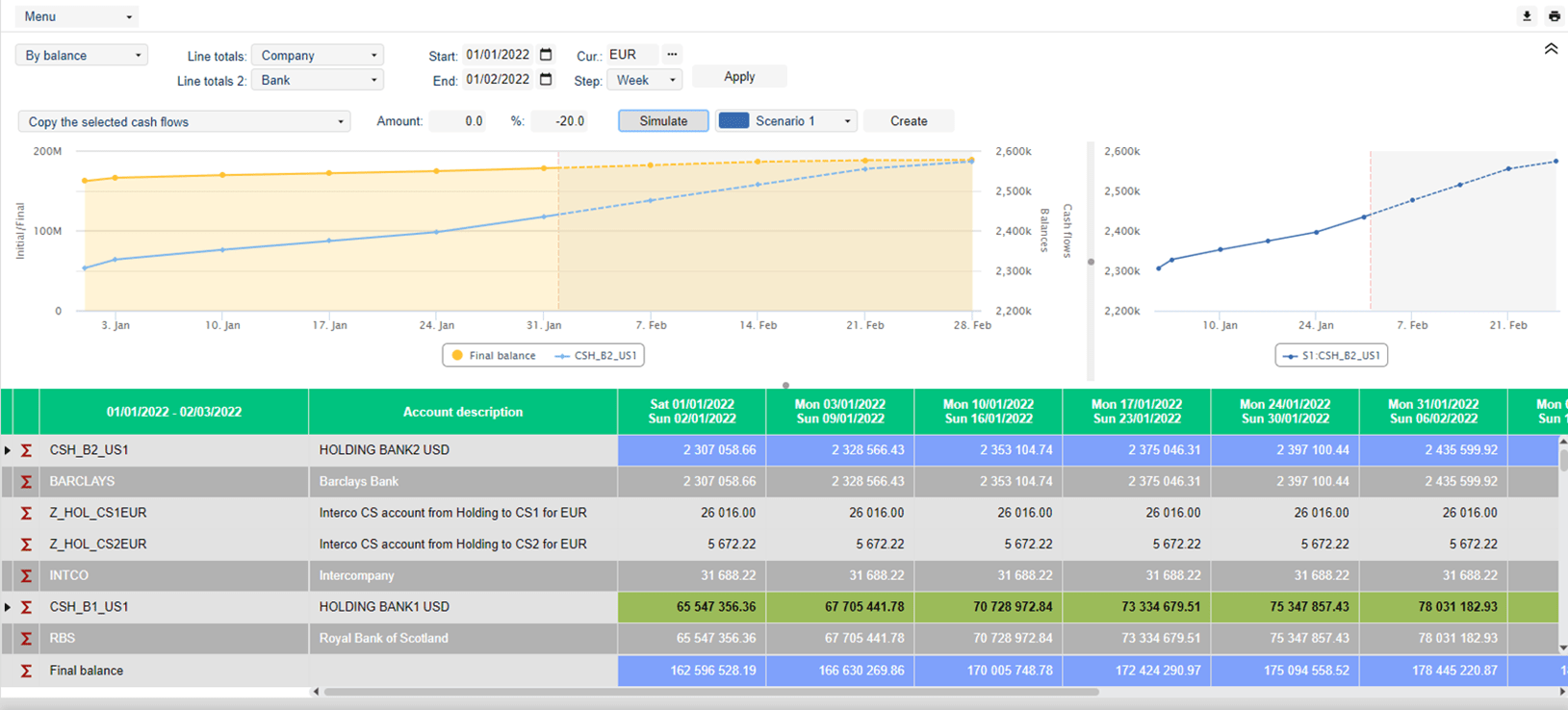

- Automatic reconciliation between actual/forecast data based on flexible rules

- Deviation analysis

- Fully configurable position worksheet

- Visibility on balances, by country, company, bank, account, flow code or budget code

- Fully configurable filters and analysis parameters

- Breakdown to access detailed information

- Information from both bank statements and the ERP linked to payments and forecasts

BANK CONNECTIVITY

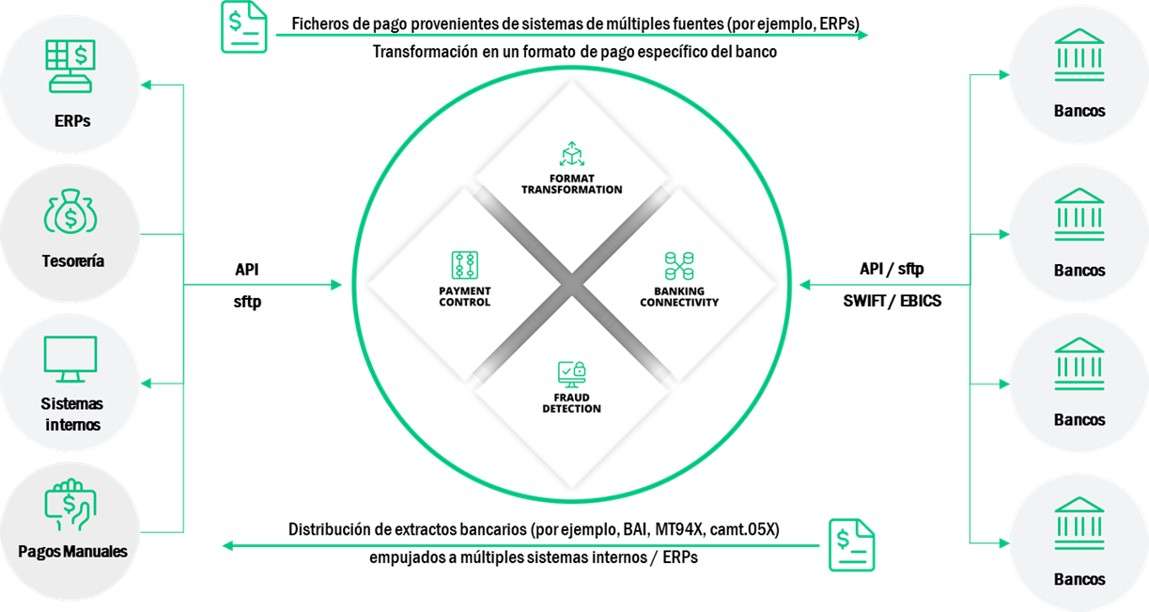

The integrated connectivity hub is an essential part of the SaaS solution that we propose.

This allows each customer to monitor exchanges (incoming/outgoing) from the platform, to take advantage of all standard interfaces (with ERPs and banks, formats, etc.).

More than 1,000 active, configured and tested banking connections for plug-and-play ERP and TMS connectivity.

CASH MANAGEMENT

Data exchange in an automation solution allows customers to set up simple interfaces within the application by defining the external structure of files and the mapping of fields.

Users can easily drag and drop files manually, or have files automatically retrieved from another system via SFTP/FTPS/API. Imported items are directly visible in the cash position worksheet. Imported items are directly visible in the cash position worksheet.

We also offer the possibility to configure the terms of account charges, as well as the terms of bank flow fees, the link between fee and flow codes to automatically identify bank fees and perform variance analysis.

CASH ACCOUNTING

Define the accounts plan you are interested in. Whether you focus on bank fees and balance transfers or the complete bank statement, you can can choose the applicability of the accounts plan (country, company, account) and define the GL scheme you are interested in for each type of cash flow (debit/credit) with multiple criteria.

You can enhance the data sent to the ERP with additional fields and, where necessary, you can define allocation rules for more accurate generation of general ledger entries.

Advanced rules allow you to search for data within fields and to base the generation of general ledger entries on these rules. GL entries are generated automatically through scheduled processes that can also be triggered manually.

IN-HOUSE BANK (IHB)

Intra-group interest settlement, flexible configuration of accounts, entities, structures and workflows, multi-level entity structures, internal bank balances, monitoring of banking powers of attorney.

The functionality of IHB promotes cost savings, economies of scale, efficiency in the payment process and full control over the liquidity of the entire company.

The cash management solution implemented by All CMS provides cash visibility and a 90% reduction in idle capital through cash forecasting.

Why choose All CMS?

Choosing All CMS for the implementation of your cash management solution means choosing a consultancy with extensive experience in the implementation of Treasury and Payment Systems automation projects.

It is a guarantee of success in your project and provides the peace of mind that comes from working with one of the leading specialists in national and international cash management projects in the market.

The years of experience of our certified consultants are placed at the service of the customer from strategy design to implementation, always speaking the same language.

Concepts such as digitalisation, process optimisation and reporting are part of our DNA, with excellent professionals and their previous experience in finance and treasury.

We have the capacity to take on both national and international projects

We have been a Kyriba Certified Partner since 2011

We are the only Kyriba Spain partner to offer 1st level support

We have a unique know-how at the service of Financial Management

Discover the perfect solution to optimise your cash management!

Are you looking for a solution that integrates cash management, liquidity forecasting, banking connectivity and financial transactions with maximum visibility to support successful decision making?

Some of the consulting and implementation projects of cash management solutions carried out by All CMS

How Minor Hotels centralises and automates cash management

Cash Management Automation, Cash Management CentralisationFAQs about the cash management solution

Which processes in your cash management do you perform manually and which take up a lot of your time?

A cash management system is able to automate many of the tasks that would otherwise have to be done manually. The receipt of bank statements, the uploading of forecasts, the reconciliation of forecasts and actuals, the company’s liquidity position. etc.

What kind of connectivity does Kyriba use to connect to banks?

Kyriba has a connectivity hub from which it can connect to banking institutions via APIs, local protocols (e.g. Editran) Swiftnet (Service Bureau, AL2 BA, Bank Concentrator) SFTP…

Why choose a cash management automation solution?

To avoid spending hours manually performing tasks and use that time for decision-making and analysis.

How to choose the implementer of the cash management solution?

The most important thing in a TMS implementation project is not so much the solution but the implementer. It is very important to choose an implementer that has extensive experience in this type of project, as well as resources officially certified by the manufacturer, in order to have all the guarantees of a successful project. In the case of international projects, the experience that the implementer may have in similar projects in the countries that are part of the scope of the project is important.

Is the tool secure?

Kyriba’s SaaS tool has all the internationally required security certificates. Kyriba’s investment in security is of vital importance as the security of its platform is the most important pillar of its raison d’être.

Creating value with active liquidity management is in your hands

Would you like to know the full potential of All CMS solutions? Our experts in each area of expertise are available for a customised demo.