CONFIRMING AND WORKING CAPITAL

Supply Chain Finance (SCF) Solution

Optimize liquidity and improve management of accounts payable and receivable through SCF opportunities:

- Controls cash flow to facilitate payment management

- Reduces financial and operating costs

- Improved collaboration and trust with suppliers

- Obtaining access to capital in an agile and efficient manner

With a Supply Chain Finance solution, the entire supply chain benefits, thanks to prepayment financing and dynamic discounts. Finance departments optimize working capital and strengthen supplier relationships.

Successful implementation of a Confirming tool

The role of the CFO and treasurers in the implementation of Supply Chain Finance

The finance department is the strategic area of an SCF initiative. Its objective is to optimize the cash position either by reducing excess liquidity in exchange for a higher return or by creating free cash flow by extending days outstanding.

Supply Chain Finance management is a competitive advantage

Improves company profitability

More efficient cash flow management

Optimization of working capital

Improved visibility of supplier accounts

Build more beneficial relationships with suppliers through payment flexibility

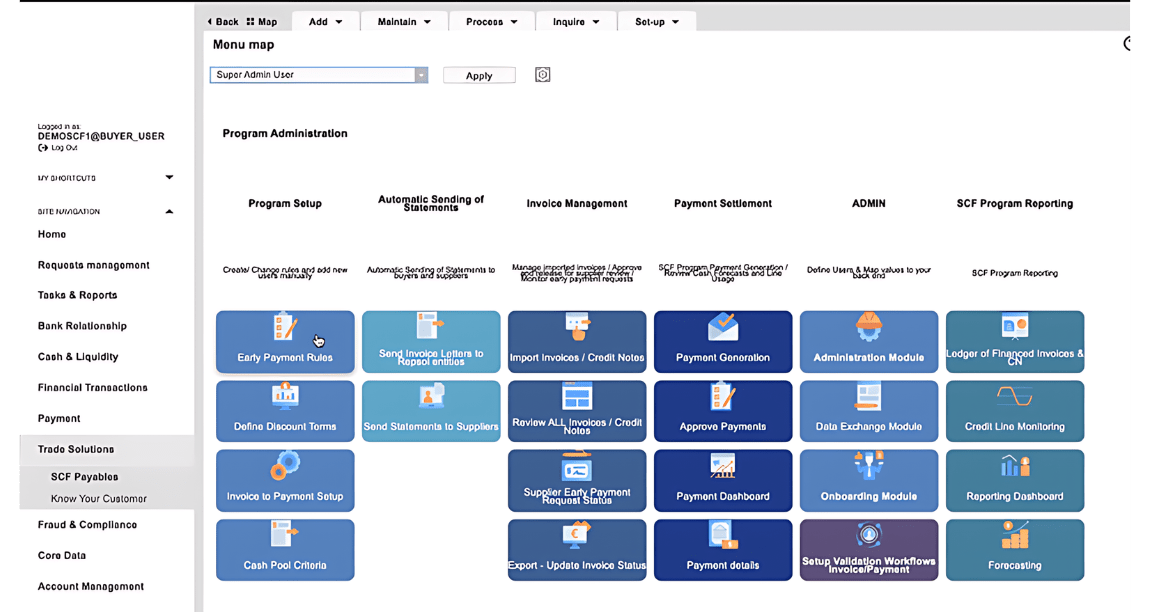

Automated Supply Chain Finance Solution

Integrates, parameterizes and simplifies the relationship with suppliers from a single platform

Supply chain finance or SCF, also known as reverse factoring, accounts payable financing or confirming, is a financial instrument that offers advance payment programs, thus creating a win-win situation for buyers and suppliers.

Debt Financing

- Increase free cash flow and improve net income with prepayment financing solutions.

- It offers suppliers access to much-needed liquidity and helps compare current payment terms.

- Uses surplus cash and liquidity or integrates financial partners to execute prepayments of invoices or purchase orders.

- Programs of various types can be supported simultaneously.

Financing Accounts receivable

- Allows sellers to access early payment of outstanding accounts receivable.

- Centralizes and simplifies all receivables financing programs in a single portal.

- Maintain control of the most efficient funding sources for accounts receivable.

- Increase sales, reduce the credit risk position and boost the organization’s cash position.

- Pre-engineered bank and ERP connectors for complete integration of multiple receivables facilities from different funding sources.

All CMS offers a global view of cash management, liquidity forecasting, banking and financial transactions, allowing you to detect improvements in cash performance and optimise cash controls.

Automated Supply Chain Finance Solution

Integrates, parameterizes and simplifies the relationship with suppliers from a single platform

Supply chain finance or SCF, also known as reverse factoring, accounts payable financing or confirming, is a financial instrument that offers advance payment programs, thus creating a win-win situation for buyers and suppliers.

Debt Financing

- Increase free cash flow and improve net income with prepayment financing solutions.

- It offers suppliers access to much-needed liquidity and helps compare current payment terms.

- Uses surplus cash and liquidity or integrates financial partners to execute prepayments of invoices or purchase orders.

- Programs of various types can be supported simultaneously.

Financing Accounts receivable

- Allows sellers to access early payment of outstanding accounts receivable.

- Centralizes and simplifies all receivables financing programs in a single portal.

- Maintain control of the most efficient funding sources for accounts receivable.

- Increase sales, reduce the credit risk position and boost the organization’s cash position.

- Pre-engineered bank and ERP connectors for complete integration of multiple receivables facilities from different funding sources.

All treasury processes can be automated

Liquidity is the lifeblood of any business, yet fragmented data and processes force CFOs and their teams to go the extra mile to see, protect, move and grow liquidity in order to improve financial performance.

A reliable treasury system helps finance managers promote new practices, unify real-time data and digitally transform their businesses to improve liquidity and unlock opportunities to drive growth.

Our solution, available via API, facilitates complete cash management, as well as risk, payment and working capital management. CFOs and treasurers gain productivity, analytical capabilities and access to reliable data to protect balance sheets, improve cash returns, accelerate processes and optimise liquidity.

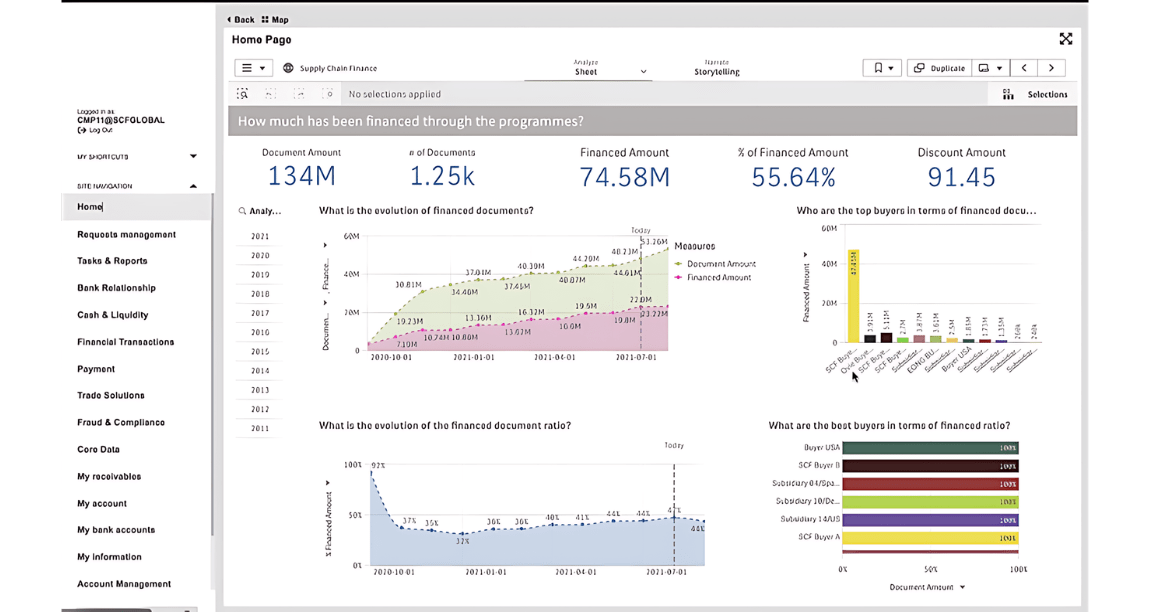

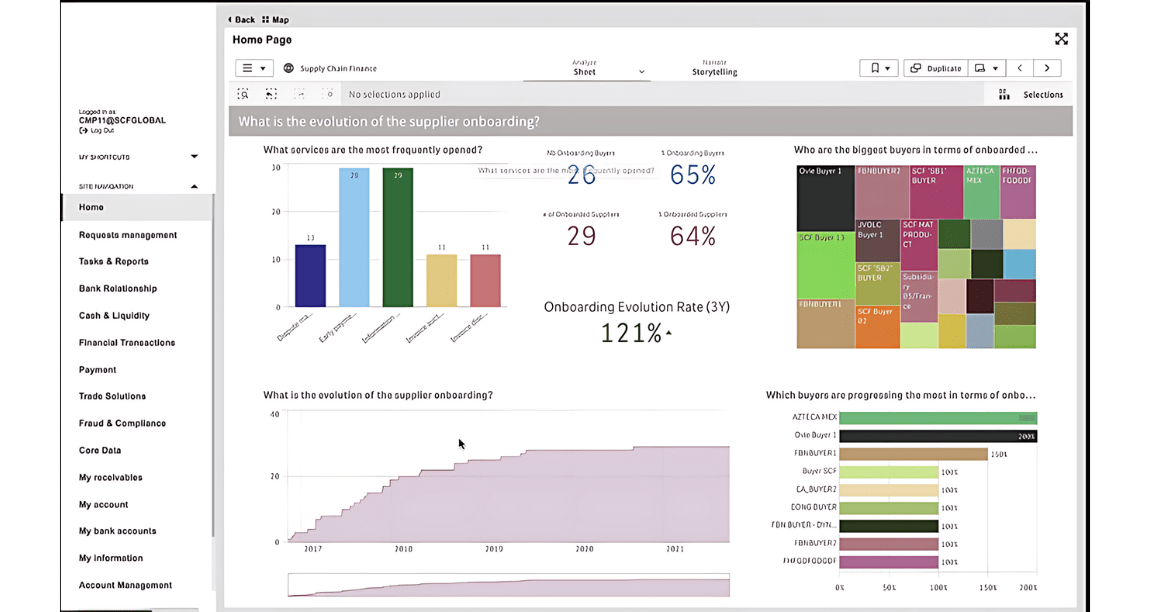

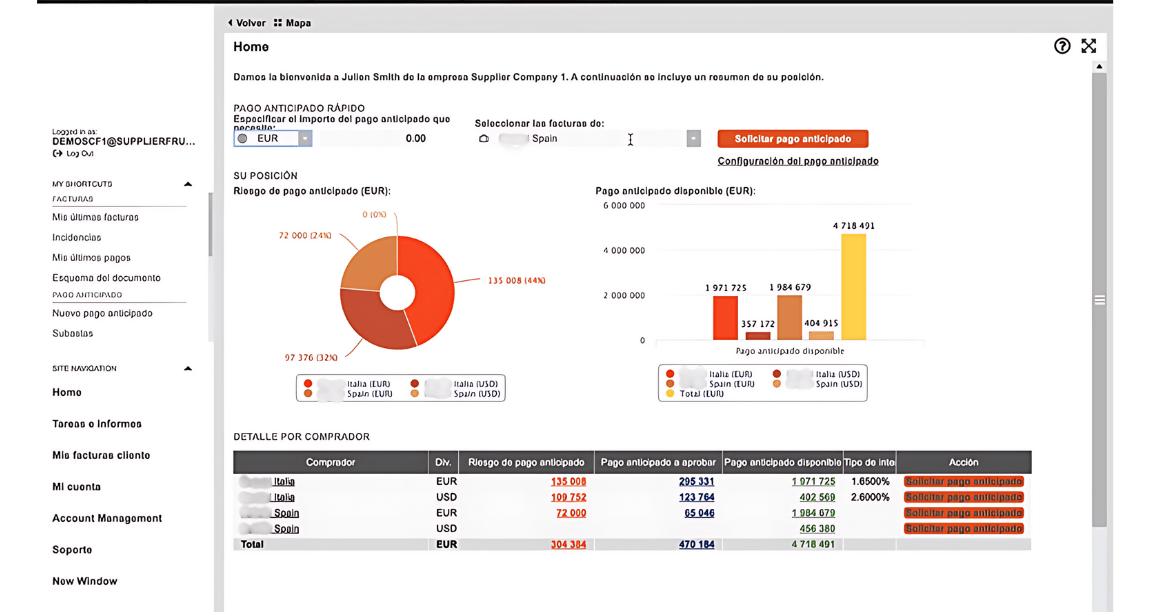

How does the Supply Chain Finance solution work?

Facilitating the interaction between a company and its suppliers through a SCF solution is an alternative to other payment systems. It simplifies administrative and financial procedures and offers financing to suppliers.

- Reduces administrative work by outsourcing the processing of information and the preparation of payment orders.

- Improved corporate image with suppliers.

- Strengthen your position when negotiating with suppliers.

- Improve cash management by simplifying cash flows.

- Possibility to advance 100% of the invoices pending collection immediately and without being subject to any prior risk study.

- It does not consume its own debt capacity.

- Anticipation of invoice collection to eliminate the risk of unpaid invoices.

- Preferential financing conditions.

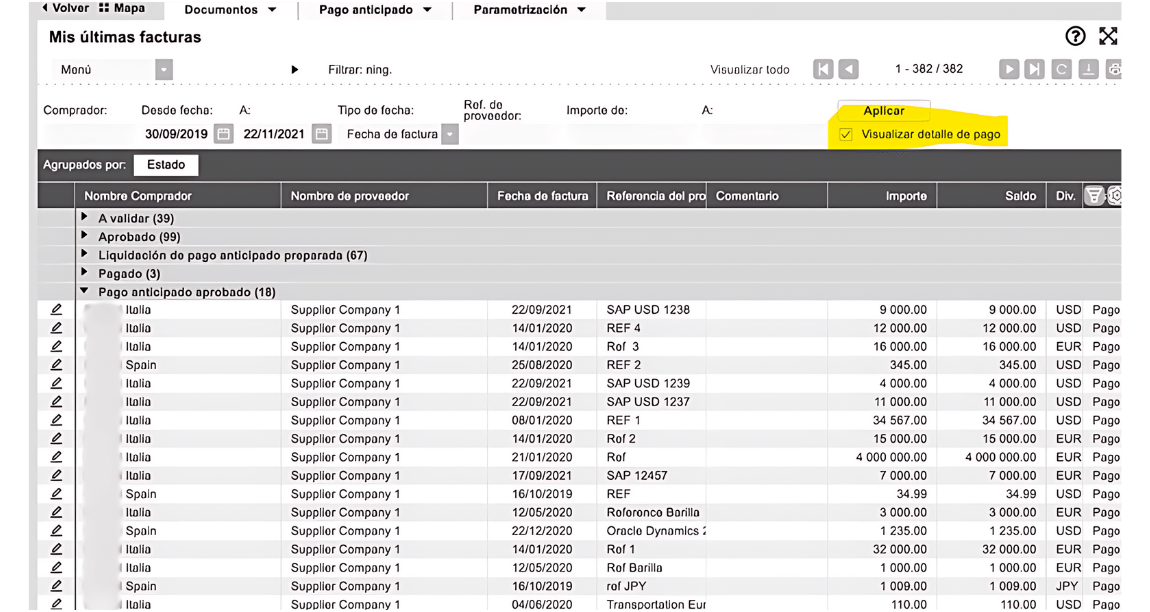

Registration and Access

Suppliers register on the portal by providing relevant information such as contact details, products or services offered and bank details. Once registered, they can access the portal using credentials.

Communication and consultation

Suppliers can consult relevant information, such as purchase orders, pending invoices, payments made and commercial agreements. They can also communicate with the company through the portal to resolve doubts or send messages.

Invoice upload

Suppliers can upload their invoices electronically on the portal. These invoices are automatically validated according to the rules established by the company. If there are discrepancies, the supplier is notified for correction.

Approval and Follow-up

Invoices go through an internal approval process within the company. Managers review and approve or reject invoices. The supplier can follow the status of their invoices in real time.

Payment and reconciliation

Once approved, invoices are scheduled for payment according to the agreed terms. The portal also allows for payment reconciliation, verifying that invoices have been paid correctly.

Reports and analysis

Supplier portals generate reports on supplier performance, payment times, transaction volumes and other relevant indicators. This helps the company make strategic decisions.

Excellence in supply chain management is an important element of a company’s value chain and constitutes a competitive advantage.

Why choose All CMS?

Choosing All CMS for the implementation of your cash management solution means choosing a consultancy with extensive experience in the implementation of Treasury and Payment Systems automation projects.

It is a guarantee of success in your project and provides the peace of mind that comes from working with one of the leading specialists in national and international cash management projects in the market.

The years of experience of our certified consultants are placed at the service of the customer from strategy design to implementation, always speaking the same language.

Concepts such as digitalisation, process optimisation and reporting are part of our DNA, with excellent professionals and their previous experience in finance and treasury.

We have the capacity to take on both national and international projects

We have been a Kyriba Certified Partner since 2011

We are the only Kyriba Spain partner to offer 1st level support

We have a unique know-how at the service of Financial Management

Try the SCF solution now!

Through supply chain finance, reductions in the cash conversion cycle and optimal levels of working capital are achieved.

Some of the consulting and implementation projects of accounting solutions carried out by All CMS

FAQs about the accounting reconciliation solution

Which processes in your cash management do you perform manually and which take up a lot of your time?

A cash management system is able to automate many of the tasks that would otherwise have to be done manually. The receipt of bank statements, the uploading of forecasts, the reconciliation of forecasts and actuals, the company’s liquidity position. etc.

What kind of connectivity does Kyriba use to connect to banks?

Kyriba has a connectivity hub from which it can connect to banking institutions via APIs, local protocols (e.g. Editran) Swiftnet (Service Bureau, AL2 BA, Bank Concentrator) SFTP…

Why choose a cash management automation solution?

To avoid spending hours manually performing tasks and use that time for decision-making and analysis.

How to choose the implementer of the cash management solution?

The most important thing in a TMS implementation project is not so much the solution but the implementer. It is very important to choose an implementer that has extensive experience in this type of project, as well as resources officially certified by the manufacturer, in order to have all the guarantees of a successful project. In the case of international projects, the experience that the implementer may have in similar projects in the countries that are part of the scope of the project is important.

Is the tool secure?

Kyriba’s SaaS tool has all the internationally required security certificates. Kyriba’s investment in security is of vital importance as the security of its platform is the most important pillar of its raison d’être.

Supply Chain Finance with API connection, ERP integration and supplier onboarding

Would you like to know the full potential of All CMS solutions? Our experts in each area of expertise are available for a customised demo.