ACCOUNTING AND ACCOUNTS RECONCILIATION

Accounting solution

Easing the burden of manual tasks on the finance team so that they can focus on other high value-added tasks that impact the company’s strategy is made easier if you automate the accounting of transactions directly from treasury.

- Integration with any ERP or accounting system that allows file integration.

- Automatic retrieval of accounting entries to the ERP through automatic processes

- User-defined mapping rules with flexible criteria

- Mapping and scanning criteria for high accuracy in entry generation

- User configuration of rules, without relying on the IT department

- Optimisation of month-end closing tasks

By implementing an accounting solution, finance teams can, from a single tool, export cash flows, generate double-entry accounting entries for internal and bank cash transactions, with action traceability and data integrity control.

Promote the valorisation of the accounting function and employee loyalty.

Opting for a secure and traceable accounting solution that can be set up

From a single platform, minimise accounting data entry time and reduce the risk of error to support the accounting department with an interface between the TMS and the ERP.

File or API connection in a standard structure

User-definable general ledger entry generation rules (based on flexible criteria)

User-defined configuration of the rules, without depending on the IT department

Automatic generation of rules-based accounting entries

Reduction of month-end closing efforts

Integration with ERP of the market through API: SAP, Oracle, Microsoft Dynamics, Netsuite…

All CMS offers a global view of cash management, liquidity forecasting, banking and financial transactions, allowing you to detect improvements in cash performance and optimise cash controls.

Automatic accounting solution

Connect, set-up and simplify accounting reconciliation with a single tool

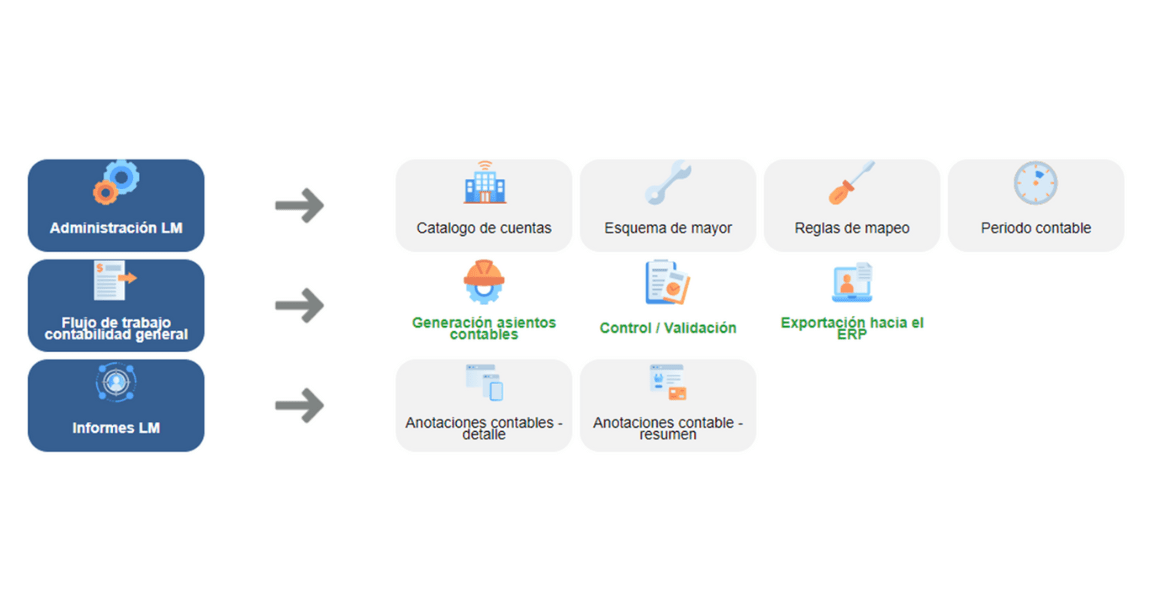

Automated bookkeeping supports the accounting team by streamlining data analysis and optimising decision making based on instant information. Having an intuitive solution adapted to the accounting system of the business offers greater visibility, agility and traceability of cash and transactions:

- Ledger administration process configured according to the catalogue of accounts, G/L scheme, mapping rules and accounting period adjustment.

- Workflow configuration in general accounting.

- Own assignment rules for the generation of accounting entries.

- Customisation of specific accounting rules to compare the bank statement with the ledger.

- Control and validation process (manual validation optional) and automatic export to ERP.

- Ledger reports with accounting entries (detail and summary).

- Connectivity between the solution and banks, as well as between the solution and ERPs.

- Programming of the import of previous days’ files from banks – BAI or MT94X files, local formats (AEB43…)

- Posting of accounting entries in the ERP from bank transactions.

- Adjustment of mapping rules based on unique bank account information, reference text, corporate entity, etc.

All treasury processes can be automated

Liquidity is the lifeblood of any business, yet fragmented data and processes force CFOs and their teams to go the extra mile to see, protect, move and grow liquidity in order to improve financial performance.

A reliable treasury system helps finance managers promote new practices, unify real-time data and digitally transform their businesses to improve liquidity and unlock opportunities to drive growth.

Our solution, available via API, facilitates complete cash management, as well as risk, payment and working capital management. CFOs and treasurers gain productivity, analytical capabilities and access to reliable data to protect balance sheets, improve cash returns, accelerate processes and optimise liquidity.

Accounting: from transaction to treasury

- Practical solution with user interface configuration without the need for coding

- Automation of accounting for receipts and payments

- Integration with ERP or own accounting system

- Visibility of the accounts plan by country, company and account

- Flexible and intuitive tool with control and validation protocols that allow the traceability of movements

- Cloud solution to reduce resource usage and deployment investment

- Instantaneous accounting and immediate access to unified data

- Notification system and validation processes with exception handling

- Reduction of administrative and repetitive tasks of the accounting team

- Minimisation of errors and duplication of information

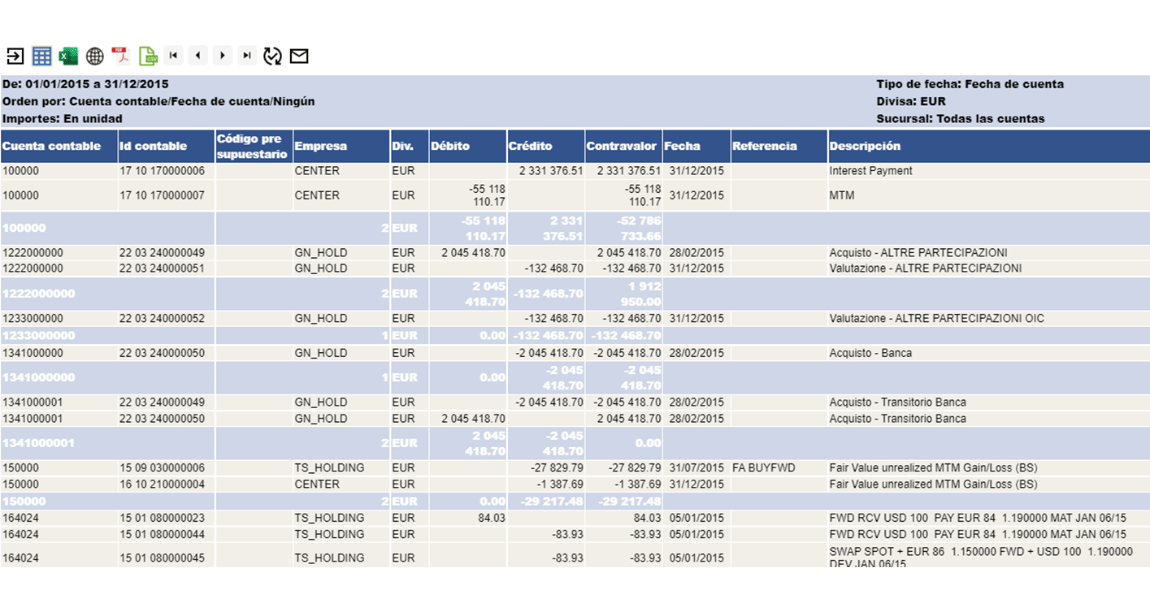

ACCOUNTING PROCESS

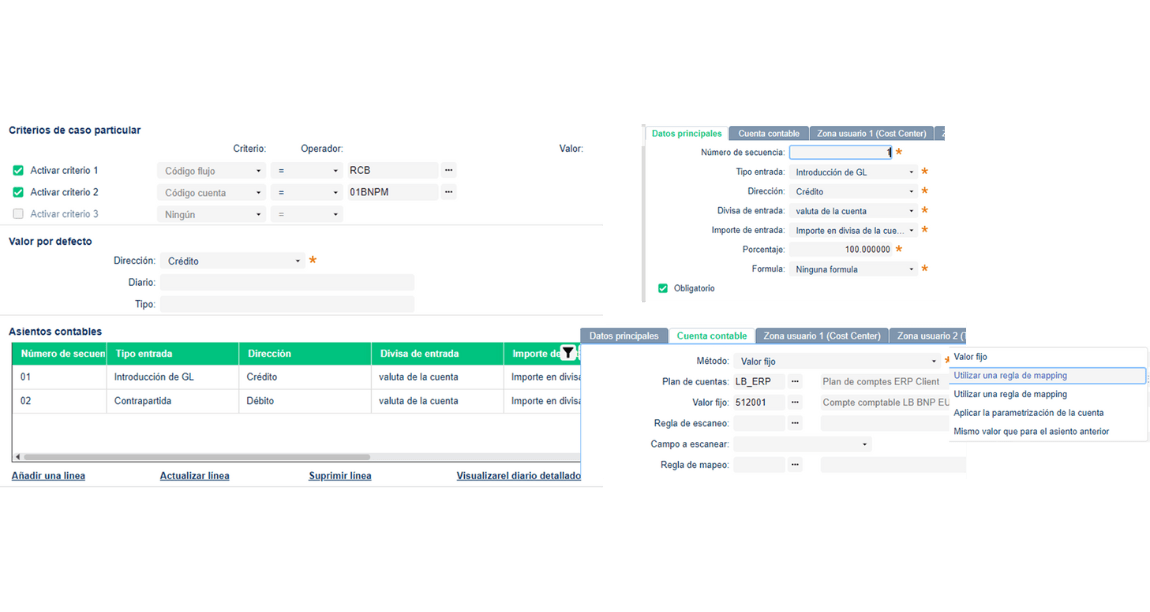

The accounting process automates the generation of accounting entries based on flexible, user-definable allocation rules. The configuration of specific accounting rules allows the comparison of the bank statement with the ledger.

Connectivity is established between the solution and the banks and between the solution and the ERPs. The import of previous days’ files from the banks is programmed and with these bank transactions, the files are sent to the ERP to create the entries.

Mapping rules based on unique information (bank account, reference text, corporate entity, etc.) and the optional manual validation process are configured prior to the automatic export of accounting entries to the ERP.

ACCOUNTING CONFIGURATION

The setting of the accounting reconciliation is done for 3 areas:

ACCOUNT PLAN: you define the plan of interest, focusing on bank fees and balance transfers or on the full consideration of the Bank Statement. The applicability of the accounts plan is chosen (Country, company, account).

ACCOUNTING SCHEME: the GL scheme of interest for each type of cash flow (debit/credit) is established with multiple criteria and the data sent to the ERP is enhanced with additional fields.

MAPPING RULE: mapping rules are defined for a more precise generation of general ledger entries, to be applied very precisely to specific types of cash flows. Flexible advanced rules allow you to search for data within fields (e.g. reference, description) and to base the generation of general ledger entries on these rules.

ACCOUNTING ANALYSIS

Entries in the GL are generated automatically through scheduled processes with the possibility to decide whether manual validation is necessary (internal workflow). From the dedicated screen for analysing the list of GL entries, you can filter, group items and view detailed information.

To extract reports on the list of accounting entries generated, filters can be applied to obtain postings in specific entities, general ledger accounts, periods, movement codes, etc. or you can obtain entries only in specific statements. There is an option to automatically generate reports as notifications to specific users.

ACCOUNTING EXCEPTIONS

The solution enables accounting exception management to be set up through an automated queue for entries not assigned to counterparties to allow analysis of ledgers that need more attention and application. This workflow improves the month-end closing process.

It achieves “up to date” accounting and, in many cases, avoids accounting reconciliation by posting directly from the statement

Why choose All CMS?

Choosing All CMS for the implementation of your cash management solution means choosing a consultancy with extensive experience in the implementation of Treasury and Payment Systems automation projects.

It is a guarantee of success in your project and provides the peace of mind that comes from working with one of the leading specialists in national and international cash management projects in the market.

The years of experience of our certified consultants are placed at the service of the customer from strategy design to implementation, always speaking the same language.

Concepts such as digitalisation, process optimisation and reporting are part of our DNA, with excellent professionals and their previous experience in finance and treasury.

We have the capacity to take on both national and international projects

We have been a Kyriba Certified Partner since 2011

We are the only Kyriba Spain partner to offer 1st level support

We have a unique know-how at the service of Financial Management

Discover the solution for easy and expeditious accounting!

It alleviates the manual workload of the finance team to perform high value-added tasks and streamline the company’s strategic decision making.

Some of the consulting and implementation projects of accounting solutions carried out by All CMS

FAQs about the accounting reconciliation solution

Which processes in your cash management do you perform manually and which take up a lot of your time?

A cash management system is able to automate many of the tasks that would otherwise have to be done manually. The receipt of bank statements, the uploading of forecasts, the reconciliation of forecasts and actuals, the company’s liquidity position. etc.

What kind of connectivity does Kyriba use to connect to banks?

Kyriba has a connectivity hub from which it can connect to banking institutions via APIs, local protocols (e.g. Editran) Swiftnet (Service Bureau, AL2 BA, Bank Concentrator) SFTP…

Why choose a cash management automation solution?

To avoid spending hours manually performing tasks and use that time for decision-making and analysis.

How to choose the implementer of the cash management solution?

The most important thing in a TMS implementation project is not so much the solution but the implementer. It is very important to choose an implementer that has extensive experience in this type of project, as well as resources officially certified by the manufacturer, in order to have all the guarantees of a successful project. In the case of international projects, the experience that the implementer may have in similar projects in the countries that are part of the scope of the project is important.

Is the tool secure?

Kyriba’s SaaS tool has all the internationally required security certificates. Kyriba’s investment in security is of vital importance as the security of its platform is the most important pillar of its raison d’être.

Automatic accounting to ensure reliability of accounting data

Would you like to know the full potential of All CMS solutions? Our experts in each area of expertise are available for a customised demo.