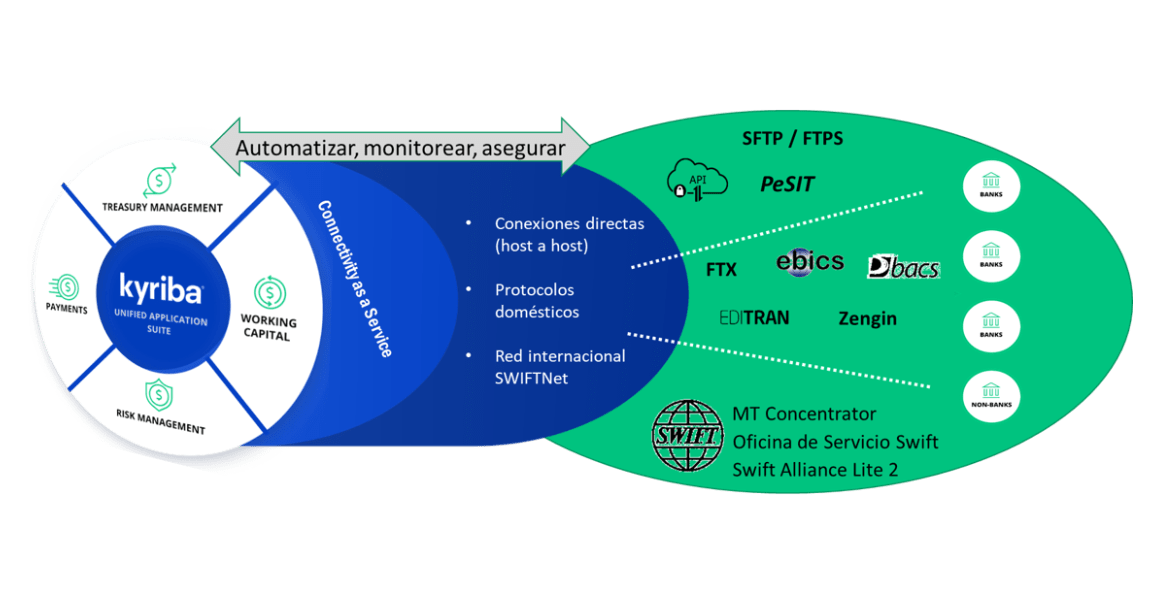

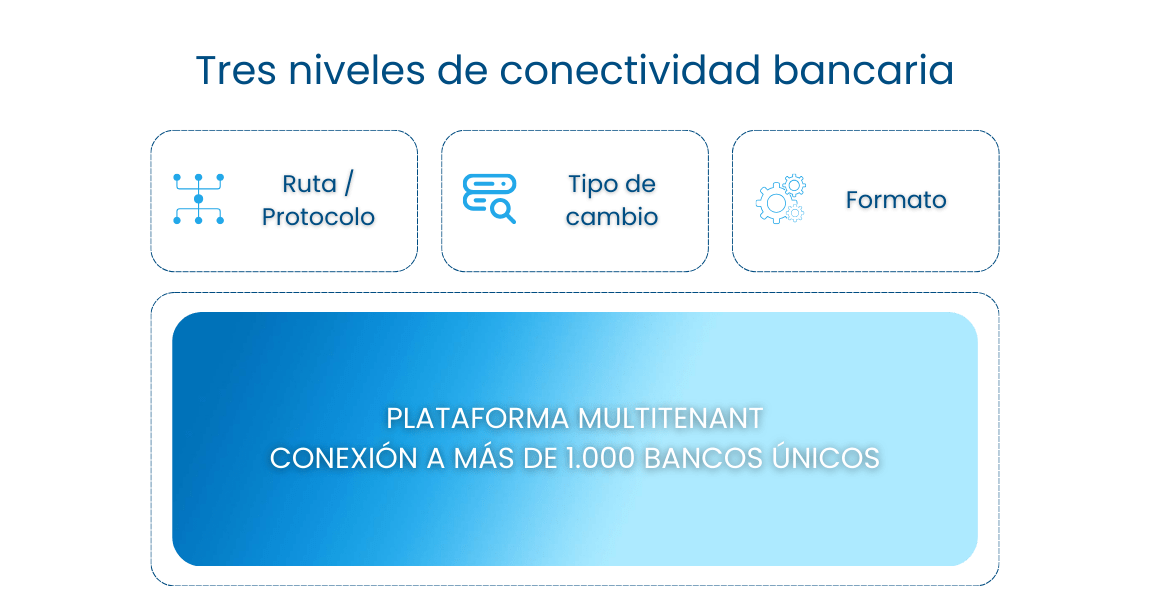

CONNECTIVITY AS A SERVICE – CaaS

Bank Connectivity Solution

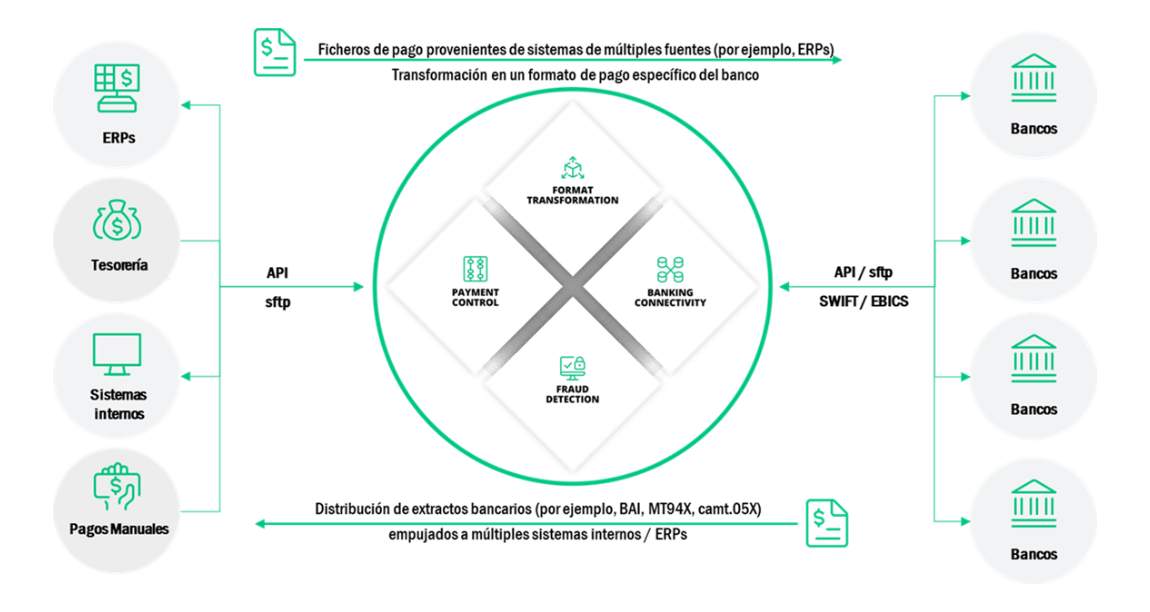

Minimize time and manual tasks by integrating your banks and ERPs into a single, centralized platform.

- Real-time transaction visibility.

- Communication with banks through multiple channels (APIs, various protocols such as Editran, SFTP, host-to-host, etc.).

- A solution featuring the largest format library on the market.

- Maximum security for banking transactions.

With the bank connectivity solution, finance teams can centralize transactions with all their national and international banks, execute payments through a single channel, and monitor cash management in real time. APIs, together with new AI-driven features, unify data to enhance decision-making.

Gain real-time access to all your banks and transactions through a multi-bank solution.

Unify the visibility of all your treasury movements

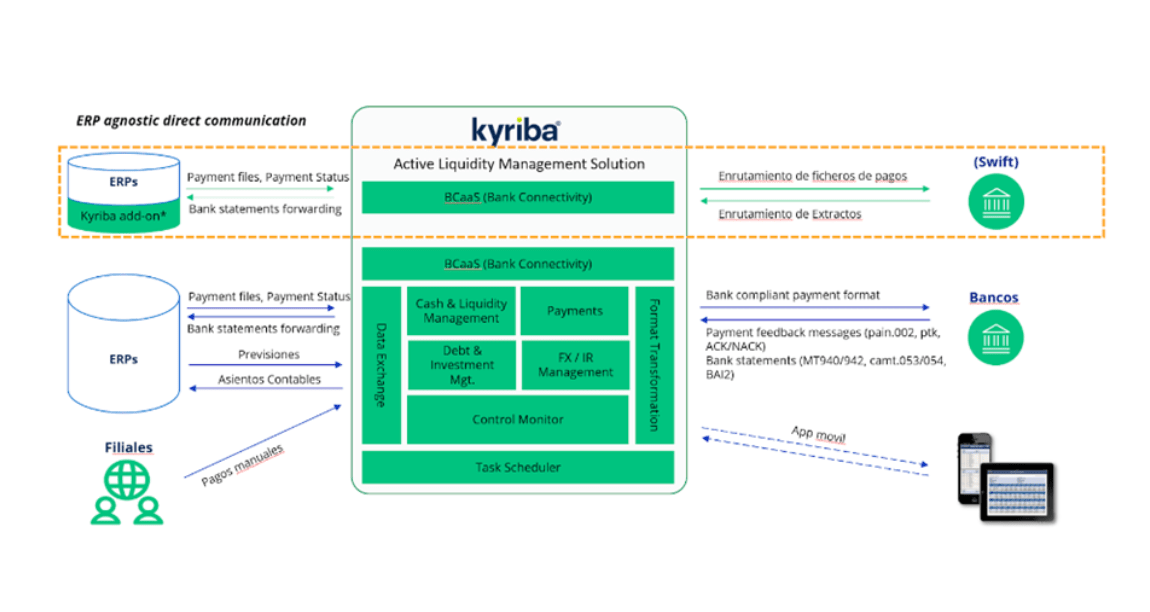

The connectivity hub is fully integrated in SaaS mode and centralizes all banking information, providing the treasury team with real-time visibility, more effective control, and informed decision-making regarding the company’s financial health.

It is no longer necessary to log into different online banking portals to manually download each company account statement.

All personal bank credentials are centralized into a single multi-bank key, allowing access to all banking data from one place.

A global communication framework connects to both national and international banks (account statements, payment file transfers, etc.).

An automated process—from the payment proposal in the ERP to the signature within the platform and transmission to each banking partner—ensures full traceability and control.

The connectivity solution operates independently of each company’s TMS or ERP, allowing seamless integration with any ERP and/or bank in a transparent and user-friendly manner.

At All CMS, we provide a global view of cash management, liquidity forecasting, banking connectivity, and financial transactions, enabling the identification of cash performance improvements and the optimization of treasury controls.

National and International Bank Connectivity Solution

Centralize and monitor your ERP and bank connections on a single platform.

Connectivity as a Service offers financiers the possibility to simplify, optimize, and secure exchanges with their banks around the world. The connectivity hub is fully integrated into the solution and allows each customer to monitor exchanges (incoming/outgoing) from the platform:

- Take advantage of all standard interfaces (with ERPs and banks…)

- All connectivity options (APIs, various protocols such as Editran, SFTP, host to host…)

- Traceability of bank files and troubleshooting

- Real-time view of the status of incoming bank statements and outgoing payments

- Controls on payment generation and statement integrations

- Improved compliance and security (SOC certifications)

- Monitor exchanges (incoming/outgoing) from the platform

- Over 1,000 active, configured, and tested bank connections for plug-and-play ERP and TMS connectivity

- Transformation of bank formats, including ISO 20022

- Real-time fraud detection

- Compliance: SOC2 Type II

Want to automate your connection with banks and ERP?

Accelerate ERP integrations

Thanks to APIs, integration with ERPs such as SAP, Oracle, NetSuite, Microsoft Dynamics, and many more is fast and secure. The solution supports more than 10,000 ERP connections for payments, bank statements, accounting entries, and master data synchronization.

This speeds up the implementation time of the connectivity project with banks and ERPs.

Reducing connection times

Automating bank connectivity optimizes manual tasks and increases the productivity of the finance department.

Certified integrations

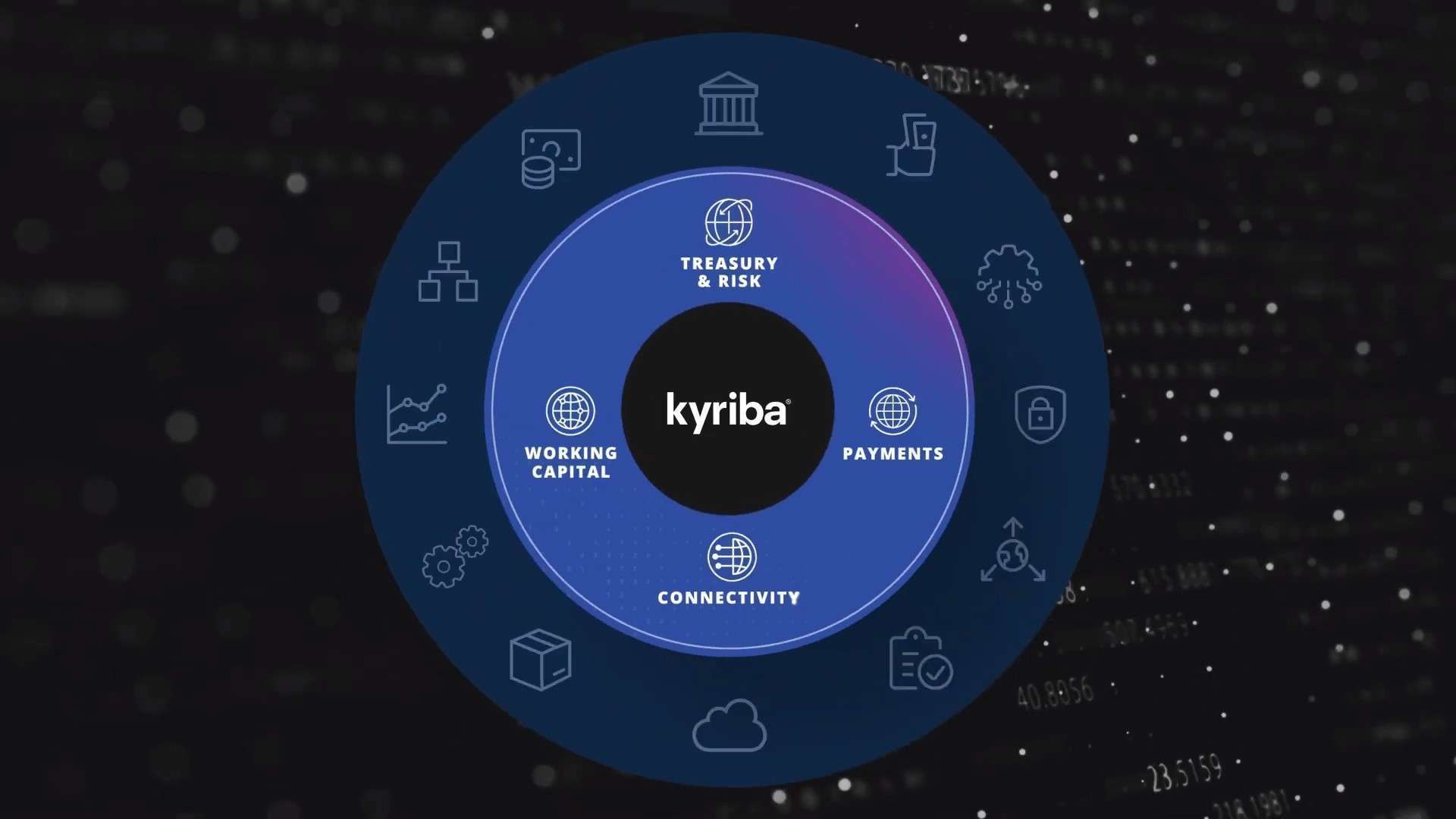

All CMS chooses Kyriba as its connectivity solution because it offers certified connections via SWIFT, APIs, Editran, SFTP, host-to-host…

At All CMS we minimize the implementation time for connections with new banks by months thanks to pre-designed bank payment formats.

Centralized, effective and global banking management

- Banking connectivity, including APIs for major banks.

- Direct connections to more than 1,000 banks (APIs, various protocols such as Editran, SFTP, host-to-host, etc.)

- ERP connectivity with certified APIs for ERPs such as Oracle, SAP, and D365.

- Real-time integrations for payments, forecasts, and working capital, all available on a single platform.

BANK CONNECTIVITY

Connect your TMS to more than 1,000 banks through certified APIs, connectivity protocols such as Editran, EBICS, SFTP, host-to-host, etc., and SWIFT (own service bureau, AL2BA, and statement hub) to accelerate and expand cash and liquidity visibility across all financial units.

Bank connectivity options:

- APIs

- Host-to-host connections

- Local protocols

- BIC MT Hub

- SWIFT Alliance Lite 2

- SWIFTNet Service Bureau

ERP INTEGRATION

The automated solution provides real-time connectivity with any ERP on the market, via certified APIs or SFTP using text files.

RED API

APIs eliminate the need for file processing and connect the ERP in real time with the publisher’s partner network (business portals, information systems, compliance solutions, validation tools, cryptocurrencies, and NFT assets, among others).

This reduces implementation time for system integration, standardizes onboarding, and provides instant access to information from internal systems or external partners, such as banks.

Treasury management APIs accelerate the flow of banking data, enabling the finance department to manage payments in real time, receive instant transaction settlement notifications, detect fraud, enrich remittance information, reduce reliance on credit lines, lower overdraft risk, eliminate batch processing, confirm FX offers instantly, and ensure seamless integration with systems and ERPs, among other benefits.

BANK FORMATS

The publisher’s format library offers more than 45,000 preconfigured bank payment format scenarios, eliminating the need for format customization during implementation-accelerating project deployment by several months.

Why choose All CMS?

Choosing All CMS for the implementation of your cash management solution means choosing a consultancy with extensive experience in the implementation of Treasury and Payment Systems automation projects.

It is a guarantee of success in your project and provides the peace of mind that comes from working with one of the leading specialists in national and international cash management projects in the market.

The years of experience of our certified consultants are placed at the service of the customer from strategy design to implementation, always speaking the same language.

Concepts such as digitalisation, process optimisation and reporting are part of our DNA, with excellent professionals and their previous experience in finance and treasury.

- We have been a Kyriba Certified Partner since 2011

- We are the only Kyriba Spain partner to offer 1st level support

- We have a unique know-how at the service of Financial Management

- We have the capacity to take on both national and international projects

Discover the Perfect Solution to Optimize Your Banking Connectivity!

Are you looking for a solution that seamlessly integrates your ERP with all your international banks to centralize your corporate banking management?

Algunos proyectos de Consultoría e implementación de soluciones de Gestión de Tesorería realizadas por All CMS

IFA Group, first Spanish company to implement Supply Chain Finance with All CMS

Cash Management Automation, Cash Management CentralisationPreguntas frecuentes sobre la solución de cash management

¿Conecta con todos los bancos españoles? ¿Y con bancos fuera de España?

Si, Kyriba tiene conexión con todos los bancos, locales e internacionales

¿Qué tipo de conectividad utiliza Kyriba para conectar con los bancos?

Kyriba tiene un hub de conectividad desde el que puede conectar con las entidades bancarias mediante APIs, protocolos locales (Ej. Editran) Swiftnet (Service Bureau, AL2 BA, Concentrador bancario) SFTP…

¿Por qué elegir una solución de gestión de pagos?

En la actualidad, de una manera u otra, todas las empresas realizan pagos electrónicos, lo habitual es utilizar las web de los bancos. El problema es que, por lo general, las empresas no trabajan con un solo banco.

Imaginemos una empresa que trabaja con 5 bancos, si paga por los 5 necesitará entrar en 5 web diferentes, con 5 passwords diferentes, con estilos, pantallas y funcionalidades diferentes, con 5 formas de firmar diferentes y con claves de firma diferentes por cada uno de los bancos.

Kyriba facilita todo el proceso de pagos multibancarios en una única plataforma, con un único password y con una sola firma para todos los bancos. Por supuesto con todos los niveles de seguridad certificados

¡Y también desde el móvil!

¿Cómo elegir un integrador de portal de pagos?

Independientemente de la solución de gestión de pagos contratada, lo más importante es que la implantación de esa solución sea un éxito y que realmente cubra todas mis necesidades de Pagos, tomando en cuenta todas sus particularidades.

Para lograr este objetivo, es vital contar con la ayuda de un implantador certificado por el fabricante en la solución contratada que tenga la mayor experiencia posible en proyectos de gestión de pagos nacionales e internacionales.

El propio implantador le asesorará a la hora de elegir la mejor opción de conectividad y pagos para resolver su problemática.

¿Cuál son los puntos mas importantes a tener en cuenta en una solución de gestión de pagos?

- Que sea una única aplicación (conectividad, gestión de pagos y formatos, firmas, etc.) ¡Todo integrado en una única plataforma!

- Movilidad: Compatible con app tanto en IOS como en Android.

- Seguridad: Es el punto más importante, la solución debe cumplir y tener las certificaciones de seguridad requeridas.

Simplifica y asegura tus intercambios financieros en un clic

¿Quieres conocer todo el potencial de las soluciones de All CMS? Nuestros expertos en cada área de especialización están a tu disposición para realizar una demo personalizada.